Comparison Summary

This comparison report of SAS® Banking Analytics Architecture vs. Riskonnect SMCR is based on a specific set of business needs and context. The comparison uses 151 Cuspera insights based on peer reviews, case studies, testimonials, and expert opinions across 50+ sources.

Introducing SAS® Banking Analytics Architecture and Riskonnect SMCR

Different products excel in different areas, so the best platform for your business will depend on your specific needs and requirements.

SAS® Banking Analytics Architecture covers Competitive Intelligence, Social Media Management, Loan Management.

Riskonnect SMCR focuses on Content Management, Sales Document Management, Workflow Management, Collaboration.

Unsure which of these solutions is right for you? Our Cuspera AI engine can compare them based on your needs and specific to your industry and context. Get your personalized report today.

About

Make fact-based decisions while ensuring consistency and reducing data prep time | SAS

Riskonnect SMCR - Include full support for the end to end SMCR process

Financials

PRIVATE

Business Need

Total Processes

(we found evidences for)

4

6

Total Goals

(we found evidences for)

1

1

Top Processes

Evidences indicate better relative satisfaction

Top Goals

Goals Achieved

-

Manage risk

-

Manage risk

Top Channels

Channels Used

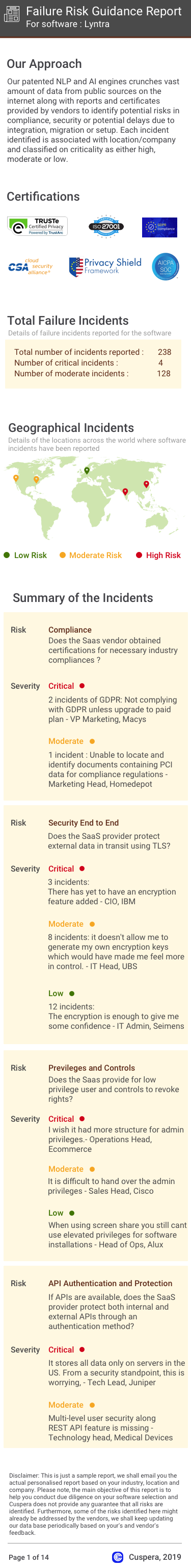

Failure Risk Guidance Security Report?

Compliance Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Security & Privacy Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Integration Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Migration Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

IT and Other Capabilities

- Low

- Medium

- High