Experian Identity Resolution Overview

Tapad-graph and Experian Marketing assist in accurately matching customer information. This enables the building of stronger customer relationships.

Use Cases

Customers recommend Advertisement, Engagement Management, Onboarding, as the business use cases that they have been most satisfied with while using Experian Identity Resolution.

Business Priorities

Acquire Customers and Enter New Markets Internationally Or Locally are the most popular business priorities that customers and associates have achieved using Experian Identity Resolution.

Experian Identity Resolution Use-Cases and Business Priorities: Customer Satisfaction Data

Experian Identity Resolution works with different mediums / channels such as Offline. Display Advertisement. and Point Of Sale.

Experian Identity Resolution's features include Personalization. and Experian Identity Resolution support capabilities include AI Powered, 24/7 Support, Chat Support, etc. also Experian Identity Resolution analytics capabilities include Analytics, and Custom Reports.

Experian Identity Resolution Customer wins, Customer success stories, Case studies

How can Experian Identity Resolution optimize your Advertisement Workflow?

How can Experian Identity Resolution enhance your Engagement Management process?

How does Experian Identity Resolution address your Onboarding Challenges?

11 buyers and buying teams have used Cuspera to assess how well Experian Identity Resolution solved their business needs. Cuspera uses 425 insights from these buyers along with peer reviews, customer case studies, testimonials, expert blogs and vendor provided installation data to help you assess the fit for your specific business needs.

Experian Identity Resolution Features

- Low

- Medium

- High

| FEATURE | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (8) |

| Analytics | Read Reviews (59) |

| Custom Reports | Read Reviews (137) |

| CAPABILITIES | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (8) |

| Analytics | Read Reviews (59) |

| Custom Reports | Read Reviews (137) |

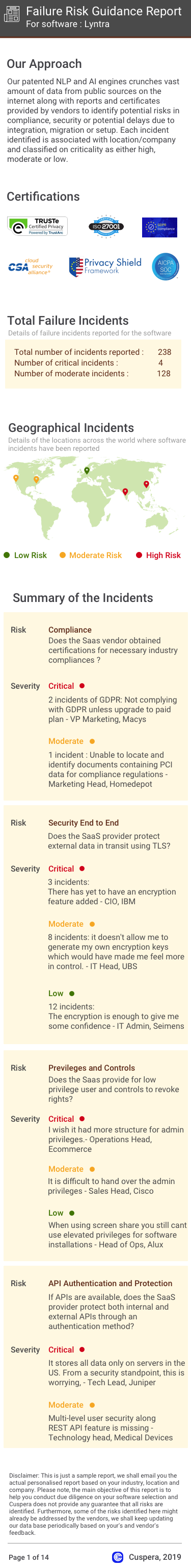

Software Failure Risk Guidance

?for Experian Identity Resolution

Overall Risk Meter

Top Failure Risks for Experian Identity Resolution

Experian Information Solutions, Inc News

Experian Named One of the World's Best WorkplacesTM for Second ...

Experian has been recognized as one of the World's Best Workplaces for the second consecutive year, highlighting its commitment to fostering a positive work environment.

Experian delivers strong first-half performance with 8% organic growth

Experian reported a robust first-half performance with 8% organic revenue growth, driven by AI innovations and expanded consumer relationships. Revenue reached $4.06 billion, with a 12% increase in benchmark EBIT to $1.15 billion. The company raised its full-year guidance, expecting 11% total revenue growth. Strategic acquisitions, including Clear Sale S.A. and KYC360, enhanced fraud prevention and compliance capabilities.

Experian Announces First Combined Credit, Cash Flow and Alternative Data Score

Experian has launched the Experian Credit + Cashflow Score, a pioneering model that integrates credit, cash flow, and alternative data. This score enhances predictive accuracy by over 40% compared to traditional models and supports lenders in making informed decisions across various financial products. It is available for testing through Experian's Ascend Platform.

Powered by Lendflow, Experian Builds Next-Generation Lending Marketplace for Small ...

Powered by Lendflow, Experian Builds Next-Generation Lending Marketplace for Small ...

Experian Information Solutions, Inc Profile

Company Name

Experian Information Solutions, Inc

Company Website

https://www.experian.com/HQ Location

Social