Meniga Overview

Meniga transforms digital banking by reshaping user experiences for financial institutions. Serving over 100 million customers in 30 countries, Meniga's solutions focus on enhancing the personalization of banking services. Financial institutions leverage Meniga to deliver tailored experiences that align with individual customer needs, improving engagement and satisfaction. This approach supports banks in navigating digital transformations smoothly, ensuring they meet modern consumer expectations without disruption. By integrating Meniga's solutions, banks can drive revenue growth and maintain a competitive edge in the rapidly evolving financial landscape.

Use Cases

Customers recommend Engagement Management, Loyalty Management, Contract Management, as the business use cases that they have been most satisfied with while using Meniga.

Business Priorities

Enhance Customer Relationships and Acquire Customers are the most popular business priorities that customers and associates have achieved using Meniga.

Meniga Use-Cases and Business Priorities: Customer Satisfaction Data

Meniga's features include Personalization, Gamification, Rewards, etc. and Meniga support capabilities include 24/7 Support, Chat Support, AI Powered, etc. also Meniga analytics capabilities include Analytics, and Custom Reports.

Reviews

"...Meniga s award winning solution helps multiple retail banks across the world create mutually beneficial digital relationships with their customers by dramatically improving their online and mobile banking user experience through innovative solutions designed to get people to think about and engage with their finances. ...." Peer review

Meniga, belong to a category of solutions that help Revenue Management. Each of them excels in different abilities. Therefore, determining the best platform for your business will depend on your specific needs and requirements.

Meniga helps banks use data to drive digital engagement, build customer loyalty, and increase revenue. Personalized digital banking solutions are offered to enhance customer experiences.

Comprehensive Insights on Meniga Use Cases

What solutions does Meniga provide for Engagement Management?

What benefits does Meniga offer for Loyalty Management?

20+ more Business Use Cases

11 buyers and buying teams have used Cuspera to assess how well Meniga solved their Revenue Management needs. Cuspera uses 424 insights from these buyers along with peer reviews, customer case studies, testimonials, expert blogs and vendor provided installation data to help you assess the fit for your specific Revenue Management needs.

Case Studies

CASE STUDY UOB

CASE STUDY Crédito Agrícola

CASE STUDY UniCredit

CASE STUDY mBank

Video

Meniga's Carbon Footprint Solution for Banks

Meniga Features

- Low

- Medium

- High

| FEATURE | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (4) |

| Analytics | Read Reviews (68) |

| Custom Reports | Read Reviews (27) |

| CAPABILITIES | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (4) |

| Analytics | Read Reviews (68) |

| Custom Reports | Read Reviews (27) |

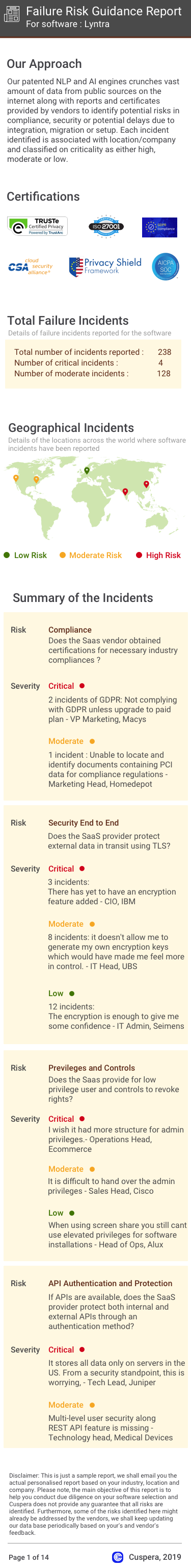

Software Failure Risk Guidance

?for Meniga

Overall Risk Meter

Top Failure Risks for Meniga

Meniga Ltd. Profile

Company Name

Meniga Ltd.

Company Website

https://www.meniga.com/HQ Location

London, England

Employees

101-250

Social

Financials

PRIVATE