Personetics Overview

Personetics transforms banking relationships by leveraging AI to deliver personalized financial insights and experiences. Serving over 150 million customers globally, this platform empowers banks to engage clients with data-driven, personalized interactions. By offering advanced personal finance management (PFM) and money management tools, Personetics enhances customer engagement and boosts revenue. The platform's capabilities include hyper-personalized insights, goal-based savings, and automated financial journeys, all designed to improve financial well-being and customer loyalty. Additionally, Personetics supports small businesses with cash flow forecasting, ensuring a comprehensive approach to financial management.

Use Cases

Customers recommend Engagement Management, Rating And Review Management, Customer Feedback Management, as the business use cases that they have been most satisfied with while using Personetics.

Business Priorities

Acquire Customers and Enhance Customer Relationships are the most popular business priorities that customers and associates have achieved using Personetics.

Personetics Use-Cases and Business Priorities: Customer Satisfaction Data

Personetics works with different mediums / channels such as Phone Calls.

Personetics's features include Personalization. and Personetics support capabilities include AI Powered, 24/7 Support, Email Support, etc. also Personetics analytics capabilities include Analytics, and Custom Reports.

Personetics, AX Semantics, Airim, Arria NLG Studio, Article Forge, etc., all belong to a category of solutions that help Conversational Intelligence. Each of them excels in different abilities. Therefore, determining the best platform for your business will depend on your specific needs and requirements.

Personetics enables banks to use AI for personalized customer engagement and increased revenue. Their platform supports money management and PFM for 140 institutions globally.

Personetics Customer wins, Customer success stories, Case studies

What Are the key features of Personetics for Engagement Management?

How does Personetics facilitate Rating And Review Management?

What Are the key features of Personetics for Customer Feedback Management?

How does Personetics facilitate Helpdesk Management?

100 buyers and buying teams have used Cuspera to assess how well Personetics solved their Conversational Intelligence needs. Cuspera uses 288 insights from these buyers along with peer reviews, customer case studies, testimonials, expert blogs and vendor provided installation data to help you assess the fit for your specific Conversational Intelligence needs.

Scotiabank - Banking

Read more →Bank of Montreal (BMO) - Banking

Read more →Akbank - Banking

Read more →Hyundai Card - Financial Services

Read more →From PFM to Money Management

Personetics Competitors

Personetics Features

- Low

- Medium

- High

| FEATURE | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (35) |

| Analytics | Read Reviews (58) |

| Custom Reports | Read Reviews (13) |

| CAPABILITIES | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (35) |

| Analytics | Read Reviews (58) |

| Custom Reports | Read Reviews (13) |

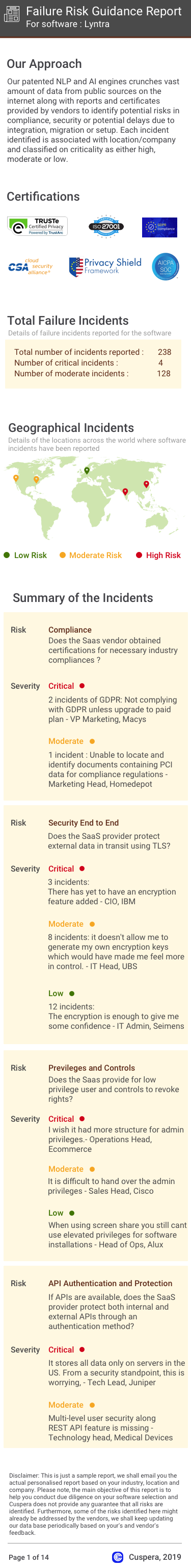

Software Failure Risk Guidance

?for Personetics

Overall Risk Meter

Top Failure Risks for Personetics

Personetics Ltd News

Personetics Rolls Out MCP Server to Help Banks Build Agentic AI Tools

Personetics has launched the MCP Server, enabling banks and fintech firms to build agentic AI applications using its predictive analytics and engagement frameworks. This platform supports the creation of personalized AI experiences, such as chatbots and virtual advisors, to enhance customer financial decision-making. The server reduces development time and complies with global financial regulations.

Personetics installs MCP server

Personetics installs MCP server

Personetics Appoints Jody Bhagat to President Global Banking , Broadening the Company Global Strategy

Personetics has appointed Jody Bhagat as President of Global Banking to enhance the company's global strategy.

Personetics welcomes new CEO Udi Ziv

Personetics welcomes Udi Ziv as the new CEO, marking a leadership change. The company also highlights its milestone of empowering 150 million monthly users with financial insights and announces an integration with Q2s digital banking platform.

Personetics Ltd Profile

Company Name

Personetics Ltd

Company Website

//personetics.comHQ Location

New York, NY 10019, US

Employees

NA

Social

Financials

NA